Cheapo Androids erode iPhone market share globally

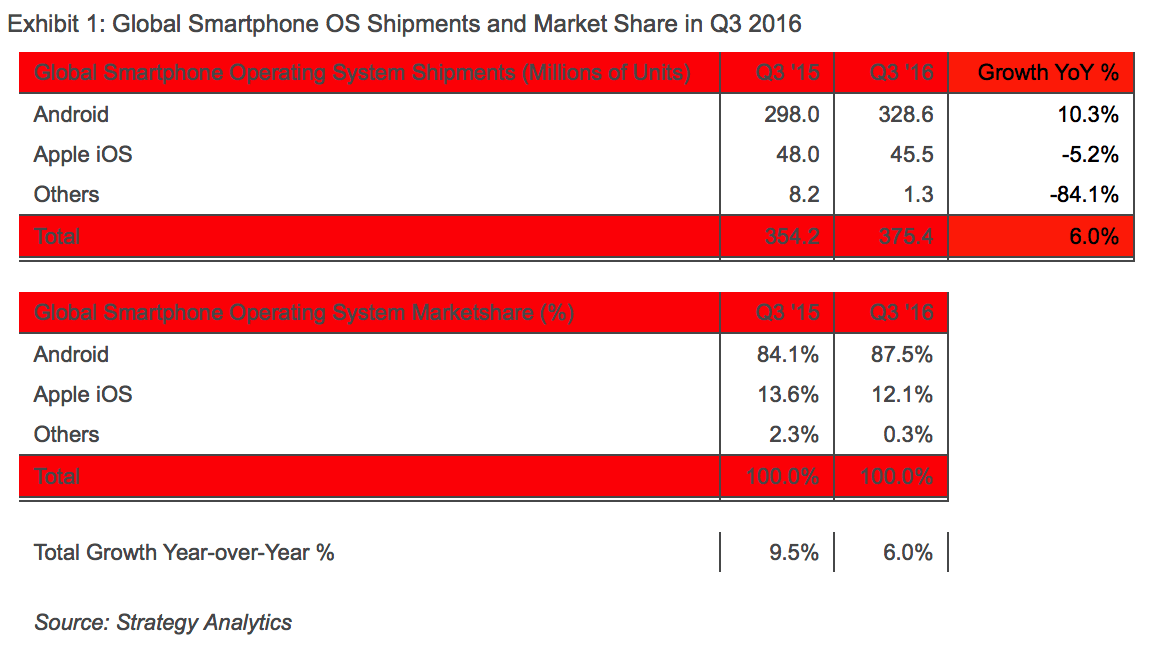

iPhones fell to just 12 percent of worldwide marketshare in Q3, claims a new report from Strategy Analytics — totting up the figures for what it claims was the fastest growth period for smartphones in one year.

Android phones, on the other hand, captured a record 88 percent of global smartphones shipments during the three month period. As for BlackBerry and Microsoft Windows Phone? Best not to ask, really!

[contextly_auto_sidebar]

“Android’s domination of global smartphone shipments remained strong in Q3 2016, with a record 88 percent of all smartphones now running Google’s OS,” Strategy Analytics executive director Neil Mawston said.

“Android’s gain came at the expense of every major rival platform. Apple iOS lost ground to Android and dipped to 12 percent share worldwide in Q3 2016, due to a lackluster performance in China and Africa. BlackBerry and Microsoft Windows Phone have all but disappeared due to strategic shifts, while Tizen and other emerging platforms softened as a result of limited product portfolios and modest developer support.”

Overall, global smartphone shipments grew 6 percent annually from 354.2 million units in Q3 2015 to 375.4 million in Q3 2016. As is to be expected with the relatively mature smartphone industry, most of the new growth came from low-cost handsets in emerging markets across Asia and Africa Middle East — mainly in countries like India and South Africa.

So is this something Apple should be worried about? On its own, global market share is a pretty meaningless statistic. Smartphone shipments also don’t necessarily tell the story since there is no guaranteed correlation with sales — and especially not profits. Pitting Android against iOS is also a silly comparison, since iOS is only available on Apple-manufactured devices.

Furthermore, as Apple pushes more and more into the Services sector, the idea of Apple having to be a hardware sales-driven company becomes less important than ever.

The smartphone market in Q3.

While Apple has made efforts to grow its market in emerging markets like India, it’s also not shown itself willing (and why should it?) to cut its profit margins to make sales that wouldn’t have an enormous positive impact on its profitability?

Ultimately, it will be interesting to see if smartphone adoption in these countries is a bit like computer sales during the 1990s, in both the consumer and education markets. In that case, low-cost companies like Dell briefly rocketed past Apple in terms of sales, only for customers to later switch back to Apple as their tastes refined.

How do you see smartphone growth playing out in the years to come? Leave your comments below.